Navigating Travel Industry Risks with Intelligent Communications

We’re going to explore some real-life unforeseen circumstances that the travel industry has had to navigate and how intelligent communications solut...

How Can Unified Communications Systems Help Banking Companies Serve Their Customers Better?

Given they’re directly responsible for the management of customers’ cash, banks should uphold consistent communications with customers, as well as maintain effective communications between staff internally and across offices and branches. However, with poor customer service and clerical mistakes being some of the most common customer complaints in the banking sector, the need for more reliable communication systems and processes is painfully clear.

Without an effective communications system, even the most established banks are at risk of alienating customers through constant mistakes, lost information and poor customer service experiences, leading them to bank elsewhere. In the modern age in which there are many digital-based banks to choose from, along with the high-street giants, maintaining a solid customer base and offering a fantastic customer experience has never been more important.

Unified communications systems offer a competitive advantage to banks of all sizes.

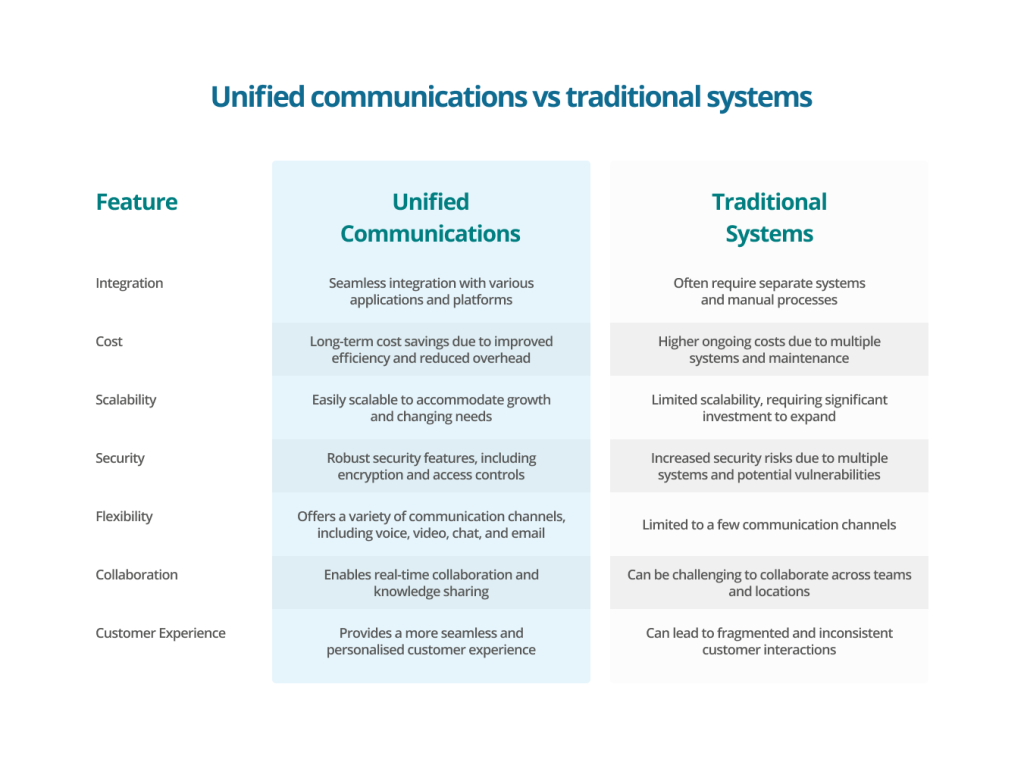

The platform provides essential communication tools for modern banks, including email, unified messaging, voice chat, video conferencing, file transfers, collaboration tools and more. By utilising unified communications, banks have the opportunity to streamline communication, raise productivity and offer greater security measures to keep customer data safe. These are just a few of the many benefits of unified communications.

But what exactly is unified communications? How can it be of service to banking institutions specifically, and are similar services (such as UCaaS solutions – more on that in a moment) just as useful? Elite Group is a leading provider of unified communications solutions tailored for banks. Our expertise in industry-specific needs, coupled with our commitment to exceptional customer service, makes us the ideal partner for your organisation. Keep reading our blog to find out more, or if you’re ready for the next step, contact us today to discover how we can help you achieve your goals.

According to our research, 38% of IT workers at large enterprises believe the main goal of onboarding unified communications should be to improve customer experiences, emphasising the potential the platform has to completely transform customer satisfaction within a business.

One way unified communications can enhance customer experiences and improve interactions is by facilitating omnichannel communication. Unified communications systems can provide a seamless omnichannel customer experience, allowing customers to interact with their bank through their preferred channel. For example, via phone, email or live chat. By giving customers more options to reach out, unified communications can help reduce the delays and hold-ups many customers experience when contacting their bank, while also serving them quicker.

On the subject of serving customers quicker, unified communications can also boost response times when contacting banks significantly. With all communications centralised in a single platform, customer service agents can quickly access customer history and context, enabling faster and more accurate responses.

Because unified communications systems are typically cloud-based, they aren’t encumbered with the same flaws and drawbacks as phone systems powered by analogue phone lines and present a more pleasant overall experience for callers. HD calling is an excellent example. When communicating via traditional phone lines, the sound quality is not acceptable and often resembles the vocals one would expect to hear on an old-fashioned radio from the 1940s. This doesn’t bode well for banks dealing with customer inquiries as key information could easily be missed. Thankfully, unified communications systems utilise VoIP (Voice over Internet Protocol) technology which can convert analogue voice signals into digital signals, so they can be easily stored or transferred on a digital system.

A helpful byproduct of this process, HD calling offers all callers a crystal-clear line of communication. Because more data can be collected, passed and converted during this process than when using analogue lines, voices sound far clearer, meaning communications can be far more effective.

On top of this, VoIP-powered communication systems are more reliable for managing and transferring calls than traditional phone lines.

Traditional phone lines can struggle to handle the high volume of calls and data required by modern businesses, especially banks. In comparison, a unified communications system offers unrivalled smooth call transfers. These communications will therefore be perceived as more reliable, meaning customers will have less reason to become disgruntled when reaching out for assistance and look upon a bank more favourably.

Efficient routing is another appealing feature bank customers can benefit from. Unified communications systems can intelligently route calls and messages to the appropriate agent for customers, based on their specific needs. This reduces wait times for customers and cuts the chances of being passed to an agent in the wrong department. But in the event a bank customer wanted to solve their own queries and answer their own questions, without the need to speak with a live agent, this is also possible with unified communications. Self-service options direct customers to the answers they need, reducing the strain on phone-based agents and further reducing waiting times.

Internally, banks and those within the financial services industry need to ensure every member of the team is performing their roles with maximum efficiency and offering the best possible service to their customers, while also dealing with the added pressures of managing large sums of money every day. But like many other office-based environments, financial institutions can fall into bad habits unwittingly due to constantly relying on unsuitable work processes or outdated legacy technology. This can lead to plummeting productivity and subpar standards.

One surefire way to raise productivity for bank employees, though, is through the use of more streamlined communications. UC systems can automate certain tasks and streamline workflows, giving agents a clear view of the work they need to prioritise the most. This not only saves them time, helping them focus on the most pressing tasks, but it also helps them provide stellar customer service.

The constant need to switch between apps can cost bank employees time, though. According to data featured in the Harvard Business Review, employees in large enterprises can toggle between applications 1200 times per day, which equates to around four hours per week of toggle time, per employee. When looked at on a small timescale, this may not seem like much of a problem. But when observed over a longer period, it represents a huge amount of time lost switching between applications, which could have been spent more wisely for the wider benefit of the business.

In terms of communications applications, many businesses – including banks and financial services companies – are still reliant on several separate applications by varying providers, which makes scenarios like the above virtually inevitable. In fact, according to the same Elite Group research referenced earlier, 7% of large companies are still running six or more separate forms of communication consistently, even though a unified communications solution could combine them all into one easy-to-use platform.

By opting for a unified communications solution, rather than multiple separate communication applications, financial professionals can further streamline their internal comms and significantly slash the need for app toggling – saving many hours of wasted time for each employee and raising productivity.

Banks can also make serious savings by eliminating subscriptions to multiple communications providers, instead relying on one all-encompassing unified communications solution for all their comms needs.

According to the 2024 Cyber Security Breaches Survey by the UK Government, 70% of medium-sized businesses and 74% of large businesses in the UK have suffered a cyber attack of some kind in the preceding 12 months. The survey also emphasises that those businesses dealing with large sums of cash were specifically targeted, meaning banks are undoubtedly at the top of cyber criminals’ hit lists.

This reinforces the need for strict and robust cybersecurity tools and measures, if banks are to stay one step ahead of criminals and protect their customers’ sensitive data, as is required by law. However, given that the majority of cyber breaches are the result of human error, with employees accidentally sharing information outside of their organisation or falling victim to phishing, businesses like banks need to reduce the risk of this happening as much as possible.

One way to reduce the likelihood of sensitive information being shared inappropriately is to contain all communications and file transfers to a single, reliable platform company-wide, such as a unified communications system.

By limiting how criminals can target certain employees and communication channels, banks are heightening their security prospects and reducing the risk of information falling into the wrong hands. Unified communications systems also incorporate tools to help detect and prevent fraudulent activities by autonomously monitoring phone calls and live chat activities between customers and agents. This can be used to help prevent criminals from accessing sensitive customer information while flagging any serious issues with the authorities, further reducing instances of fraud.

Unified communications systems offer robust cybersecurity, often including advanced security features like encryption and access controls to protect sensitive customer data. Encryption is the process of scrambling data, often between two points in cyberspace (this is known as ‘End to End Encryption’, or E2EE) which renders the data useless to anyone but the person with the correct encryption key – the recipient(s). This means that even if a cyber criminal was able to breach a bank’s network, they would be unable to make sense of any of the data, ensuring it remains safe.

Depending on their experience in cyber security for communications systems, though, some banks may not wish to manage their own security processes, instead handing them off to trained, experienced professionals. This is where UCaaS comes in.

UCaaS, or ‘Unified Communications as a Service’ offers banks and similar businesses the same tools featured in unified communications platforms. The only difference is that this platform is then managed externally by a third-party provider, with security protocols and tools also being managed externally.

By placing the management and security of cloud-based communications platforms in the hands of experienced pros, like Elite Group, IT managers and administrators can rest easy knowing their security and updates are all in hand, meaning they can focus their efforts on more pressing matters.

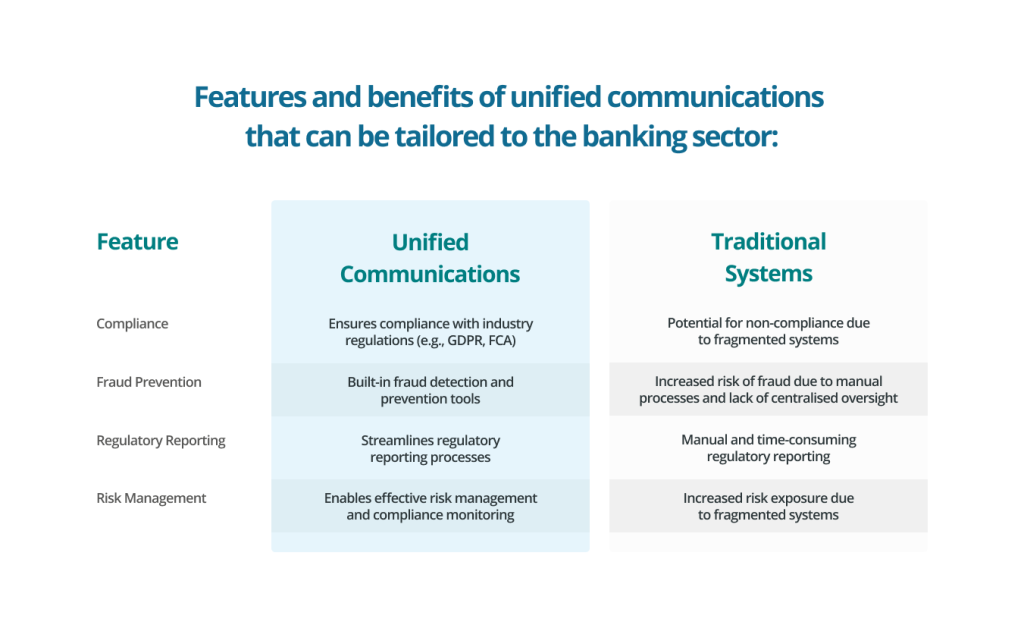

Unified communications and UCaaS systems also house features that help banks comply with any relevant compliance standards, such as GDPR and FCA, and similar, which can be a huge help in offering customers the most ironclad security possible and ensuring data is handled ethically.

In the face of an ever-increasing population and fluctuating conditions in the financial sector, banks of all sizes need to be able to pivot as quickly as possible to adapt to new and emerging demands. Banks that are seeking to increase staff numbers to meet these demands while still using analogue phone systems will undoubtedly struggle due to the restrictions this technology has over more modern solutions, like cloud-based phone systems and unified communications.

Because analogue phone systems demand the installation of fresh lines every time a new starter begins, welcoming a new member to the team can be a time-consuming and expensive process. But unified communications systems allow banks to welcome new staff members with ease at any time, helping them get to work and serve the business as quickly as possible.

As the solution is cloud-based, there is no need to install fresh lines. Instead, a new starter can simply install the unified communications app to any relevant digital device (most commonly a laptop, smartphone or tablet) and begin performing their role and serving customers virtually immediately. Thanks to this speed, the system adds not only to faster scalability but profitability too.

The cloud-based nature of the system also enables financial institutions to offer easy remote or hybrid working. With a unified communications system, bank employees can work from home – or anywhere with a stable internet connection – and still have access to all the same tools and data as their office-based colleagues, effectively allowing them to serve the business from any location. With the collaboration tools available via unified communications platforms, such as team chat and video conferencing, bank employees can benefit from better knowledge-sharing and problem-solving capabilities, even when working remotely.

Because they are hosted in the cloud, unified communications systems can assist banks in the event of a data disaster. Should a serious on-site incident result in the deletion or destruction of data housed within hard drives and servers, banks that rely on traditional data storage means would be unable to serve their customers. But by using unified communications, should an event like this occur, all data would be backed up on a server that is external to the premises, allowing it to be restored completely, minimising downtime and financial losses.

If legacy communications systems are slowing your bank’s daily business processes down in the digital age, it is time to move to a more suitable cloud-based alternative such as unified communications.

When onboarding such an important piece of technology as part of a digital transformation, businesses need to partner with reliable and experienced unified communications providers, like Elite Group.

With decades of combined experience and a plethora of industry-standard accreditations throughout our entire team, you can be sure you’ll be in the most proficient hands with Elite Group.

At Elite, you’ll be assigned a dedicated account manager who will oversee the installation of your unified communications solution, helping you deal with any teething issues along the way, so they can be resolved quickly and you can reap all the benefits as soon as possible. Plus, with technical support available around the clock, there will always be someone available to assist you.

To find out more about our unified communications solutions for banks, click here, or click the button below to speak with an Elite expert today.